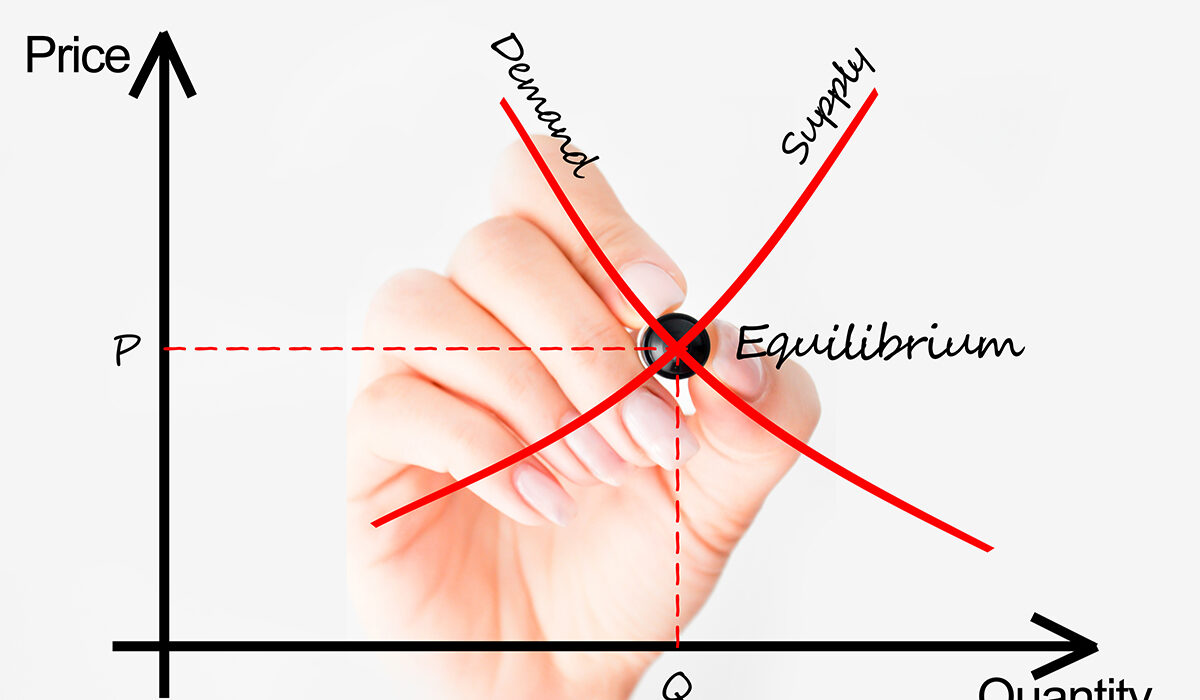

Understanding the swings in commodity prices is essential for investors, producers, and consumers in today’s interconnected global economy. What influences these pricing, one could ponder? The basic economic principles of supply and demand are at the center of this complex web of variables. The relevance of these elements and how they interact to affect commodity price changes are thoroughly explored in this article.

Factors Influencing Demand

Several factors can shift the demand curve for commodities such as:

- Consumer preferences – If consumers suddenly prefer electric cars over gasoline cars, the demand for crude oil might decrease.

- Income levels – In times of economic prosperity, consumers may demand more luxury goods, like gold or diamonds.

- Price of substitute goods – If the price of chicken goes up, the demand for beef might rise as a substitute.

- Future expectations – If consumers expect future shortages or price hikes in a commodity, they might demand more of it now.

Factors Influencing Supply

Just as there are variables influencing demand, supply too can shift due to:

- Production costs – If it becomes cheaper to produce a commodity due to technological advancements, supply might increase.

- Natural events – Natural disasters can disrupt the supply chain, leading to reduced supply. For instance, droughts can significantly impact agricultural commodities.

- Political & regulatory changes – Tariffs, embargoes, or government policies can impact the supply of commodities in the market.

- Future Expectations – If producers expect higher prices in the future, they might limit current supply to benefit later.